The Clean Energy Transition Institute (CETI) hosted a Decarbonization Forum in April 2025 with a panel of experts who explored the impact of data center energy use on the Northwest’s electricity grid and clean energy transition.

The panelists discussed a range of topics, including the challenge of surging energy demand from data centers and the desire to meet that demand with clean electricity; difficulties Oregon and Washington are facing with data center growth, such as its impact on emissions reduction targets; the critical roles of energy efficiency and demand management; and proposed solutions regarding cost allocation.

This blog picks up on that final theme–protecting ratepayers from bearing the cost of the infrastructure and transmission investments needed to support data center growth in the region–and highlights a policy to that effect that passed in Oregon’s 2025 session.

Energy is a critical and closely managed resource for data center companies. Historically, drivers of data center consumption have included internet services, cloud computing, streaming services, e-commerce, and social media. However, since 2023, a dramatic increase in global demand for artificial intelligence (AI) has added to these existing drivers and introduced questions about how to meet the projected increased energy demand. CETI’s Data Centers, Artificial Intelligence, and Energy Use 101 resource provides a high-level overview of the fundamentals of AI and data centers with relevance to energy consumption and decarbonization in the Northwest.

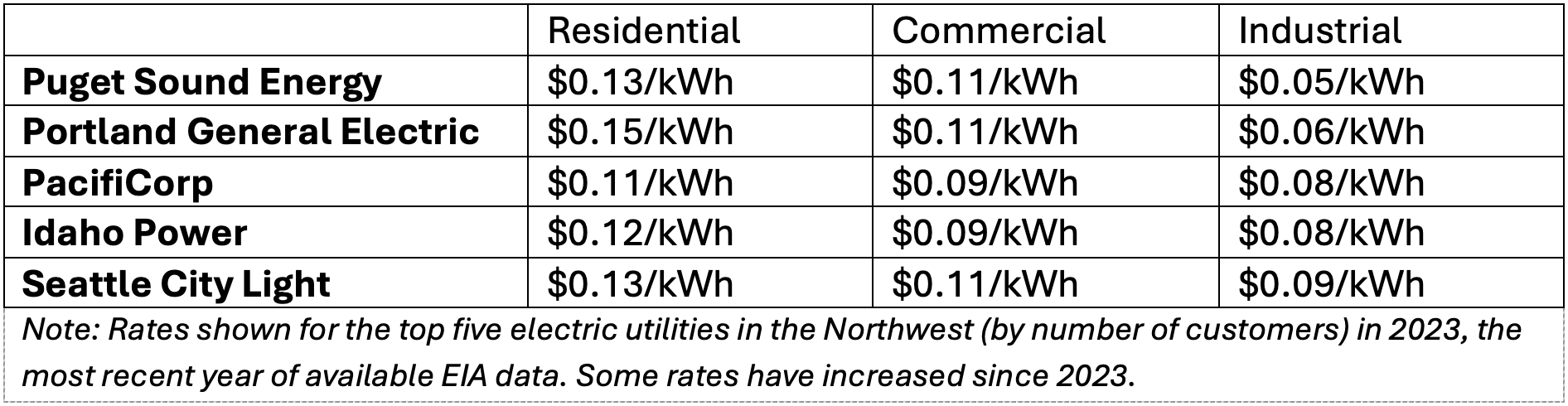

Most electric utilities have different rate structures for residential, commercial, and industrial customers – including data centers – to reflect the different costs of providing electricity to each customer type. Commercial and industrial customers usually pay lower rates than residential customers due to higher usage and more consistent demand. In the Northwest, for example, 2023 Energy Information Administration (EIA) data show the following rates for the region’s five utilities with the most total customers:

Electric utility rates are structured to recover the costs of generating, transmitting, and distributing electricity, which supports operating and maintaining grid infrastructure intended to serve all ratepayers. While this system may make sense for typical commercial and industrial customers, the recent and forecast surge in data center electricity demand has raised concerns about how other ratepayers may be unfairly paying for costs of data center electricity use and associated infrastructure needs.

Oregon has long been an attractive state for data centers due to its relatively cheap and clean hydropower electricity, mild climate (important because data center servers must stay cool), and tax breaks. Oregon currently ranks 9th among U.S. states with the most data centers according to Data Center Map and 5th in established data center markets worldwide in a May 2025 Cushman & Wakefield report.

The prominence of data centers in the state and concerns about potential impacts spurred Oregon lawmakers and advocates to come together to develop the POWER Act (HB 3546, “Protecting Oregonians with Energy Responsibility”). The bill passed with bipartisan support during the 2025 legislative session as part of an “Energy Affordability and Resilience” legislative package. The POWER Act aims to assess and address the impact of large energy users on the grid through several mechanisms, including:

Proponents of the POWER Act pointed to recent increases in energy bills for Oregonians, citing a nearly 50% increase in energy bills for Portland General Electric and Pacific Power customers since 2021. Bill opponents argued that the new regulations would discourage tech companies from expanding data center operations in Oregon.

The legislation applies to Oregon’s investor-owned utilities that are regulated by the state’s PUC: Portland General Electric, Pacific Power, and Idaho Power, which together are responsible for approximately 62% of electricity retail sales in the state and serve approximately 81% of Oregon’s total customers. The POWER Act does not apply to consumer-owned utilities, which also have data centers in their service territories and are navigating similar questions (see, for example, EWEB’s coverage of the POWER Act).

Oregon is not the only state to enact a data center-related legislation this year. According to the nonprofit Climate XChange, there were 19 data center bills enacted across 14 states in 2025. These bills mostly focused on tax incentives; rates and affordability; and grid planning and reliability.

One other Northwest state pushed through legislation in 2025 related to data centers: Montana passed HB 424, which revises the classification and taxation of data centers. In contrast to Oregon, HB 424 aims to attract data centers to Montana by providing favorable tax treatment.

The legislation extends a low tax rate to power-generating facilities connected to a data center, thereby potentially indirectly encouraging the co-location of generation—including from coal, oil, gas, hydropower, and solar—with data centers. HB 424 also extends the timeframe in which a data center property must be built and adds certain mandates for the payment of school equalization mills (a property tax rate levied to fund schools) by data center properties.

While not a legislative act, Governor Ferguson signed Executive Order 25-05 during Washington’s 2025 legislative session, which established a data center workgroup to evaluate the impact of large-scale energy consumers on the state’s economy, tax revenue, job market, energy use, tribal resources, and environment. The workgroup will recommend policies and actions the state should take to address those impacts to the Governor by December 1, 2025.

As data center energy demand continues to grow, the question of who bears the cost becomes more urgent. Other states can look to Oregon’s POWER Act as one model worth considering to address the impact on residential ratepayers of rising energy costs as data centers expand their energy-intensive operations in Oregon and the surrounding region.

To get CETI updates straight to your inbox, sign up for our mailing list.